b. New IFRSs in issue but not yet endorsed by the FSC

The Corporation has not applied the following New IFRSs issued by the IASB but not yet endorsed by the FSC. On March 10,

2016, the FSC announced the scope of IFRSs to be endorsed and will take effect from January 1, 2017. The scope includes

all IFRSs that were issued by the IASB before January 1, 2016 and have effective dates on or before January 1, 2017, which

means the scope excludes those that are not yet effective as of January 1, 2017 such as IFRS 9 "Financial Instruments"and

IFRS 15 "Revenue from Contracts with Customers"and those with undetermined effective date. In addition, the FSC announced

that the Corporation should apply IFRS 15 starting January 1, 2018. As of the date the financial statements were authorized

for issue, the FSC has not announced the effective dates of other new, amended and revised standards and interpretations.

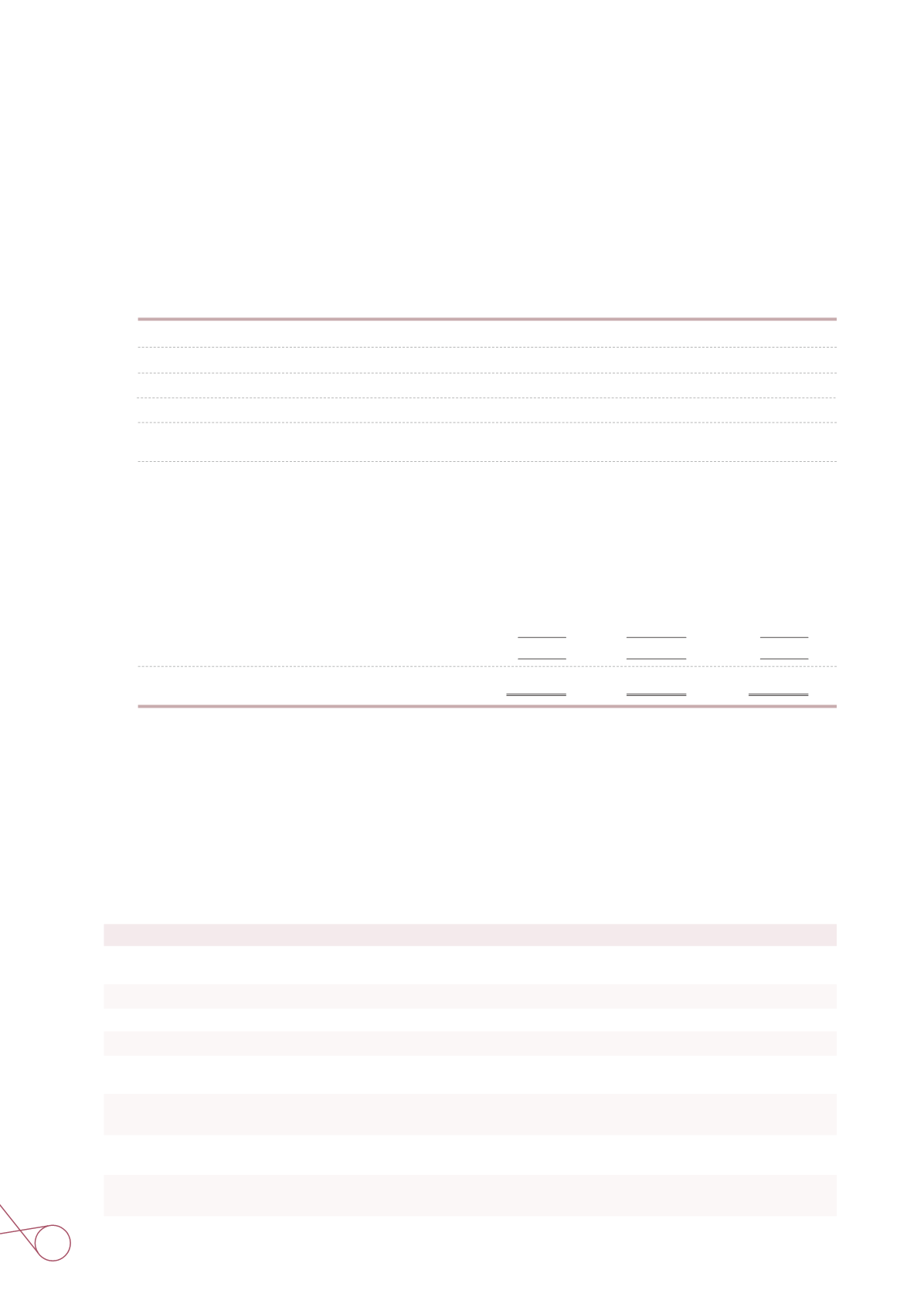

Impact on assets, liabilities and equity December 31, 2014

Accrued pension liabilities

Net defined benefit liabilities January 1, 2014

Accrued pension liabilities

Net defined benefit liabilities Impact on total comprehensive

income for the year ended December 31, 2014

Items that will not be reclassified to profit or loss:

Remeasurements of defined benefit plan

Items that will be reclassified to profit or loss:

Exchange differences on translating foreign opearations

Share of the other comprehensive income of

associates and joint ventures

Unrealized gain (loss) on available-for-sale financial

assets

Income tax relating to items that will be reclassified

Total effect on other comprehensive income for the

year, net of income tax

$ 491,596

-

646,676

-

$ 85,821

478,430

(118,127)

(117,577)

(81,333)

161,393

$ 247,214

( $ 491,596 )

491,596

( 646,676 )

646,676

$ -

-

-

$ -

$ -

491,596

-

646,676

$ 85,821

478,430

(118,127)

(117,577)

(81,333)

161,393

$ 247,214

Carrying

Amount

Adjustments Arising

from Initial Application

Adjusted

Carrying Amount

5) Revision to IAS 19 "Employee Bene ts"

Revised IAS 19 requires the interest cost and expected return on plan assets used in current IAS 19 are replaced with

a "net interest" amount, which is calculated by applying the discount rate to the net defined benefit liability or asset. In

addition, the revised IAS 19 introduces certain changes in the presentation of the defined benefit cost, and also includes

more extensive disclosures.

In addition, in preparing the financial statements for the year ended December 31, 2015, the Corporation elects not to

present 2014 comparative information about the sensitivity of the defined benefit obligation. Please refer to Note 24 for

related disclosures.

The impact on the prior reporting year is summarized as follows:

Annual Improvements to IFRSs 2010-2012 Cycle

Annual Improvements to IFRSs 2011-2013 Cycle

Annual Improvements to IFRSs 2012-2014 Cycle

IFRS 9 "Financial Instruments"

Amendments to IFRS 9 and IFRS 7 "Mandatory Effective Date

of IFRS 9 and Transition Disclosures"

Amendments to IFRS 10 and IAS 28 "Sale or Contribution of

Assets between an Investor and its Associate or Joint Venture"

Amendments to IFRS 10, IFRS 12 and IAS 28 "Investment

Entities: Applying the Consolidation Exception"

Amendment to IFRS 11 "Accounting for Acquisitions of

Interests in Joint Operations"

July 1, 2014

(Note 2)

July 1, 2014

January 1, 2016

(Note 3)

January 1, 2018

January 1, 2018

To be determined by IASB

January 1, 2016

January 1, 2016

New IFRSs

Effective Date Announced by IASB

(Note 1)

44 CPC 2016