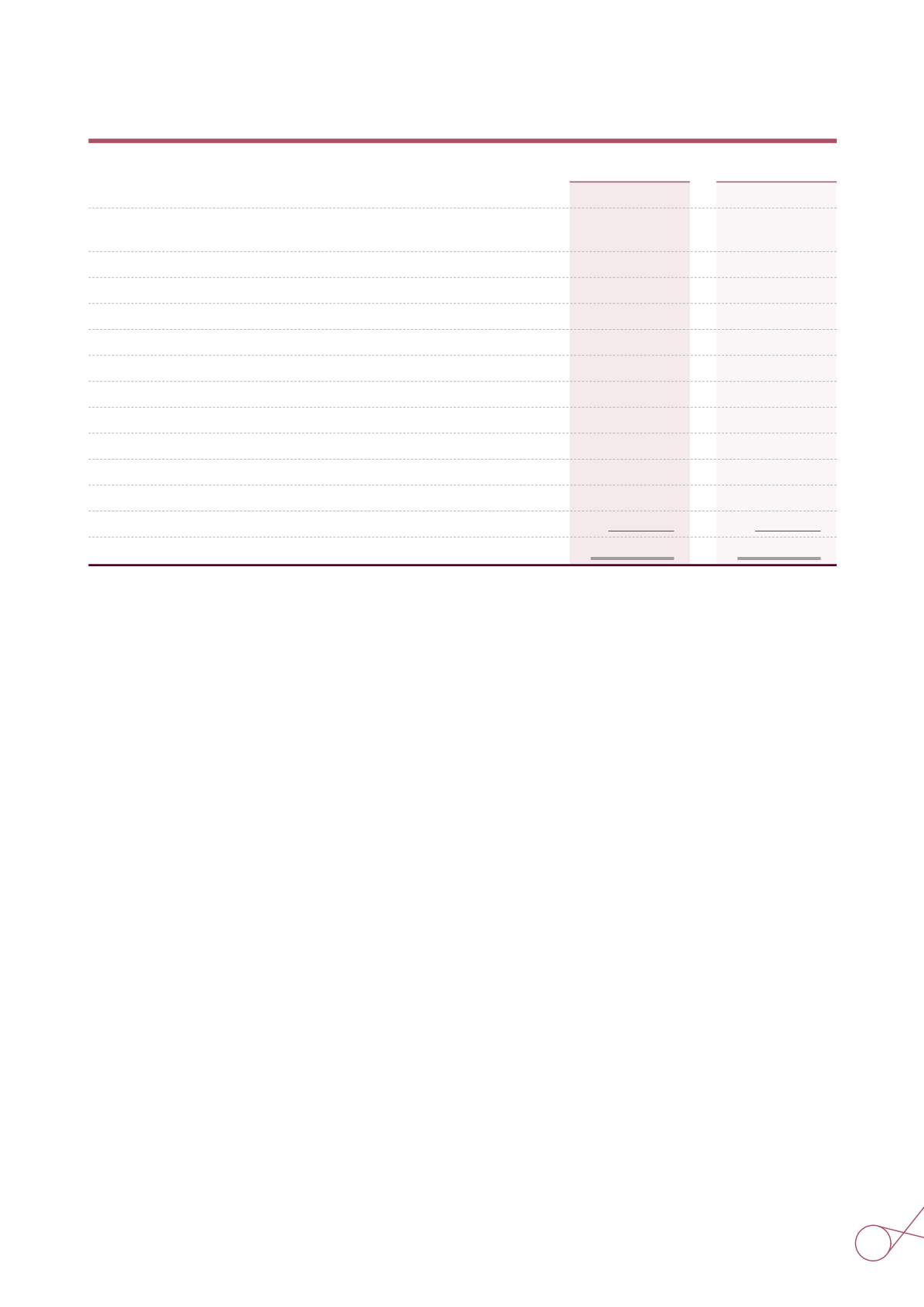

PROPERTY, PLANT AND EQUIPMENT

December 31, 2015 and 2014

(In Thousands of New Taiwan Dollars)

Land and Land Improvements

Less: Accumulated depreciation and impairment on land and Land

Improvements

Buildings

Less: Accumulated depreciation and impairment on buildings

Machinery and equipment

Less: Accumulated depreciation and impairment on machinery and equipment

Transportation equipment

Less: Accumulated depreciation and impairment on transportation equipment

Miscellaneous equipment

Less: Accumulated depreciation and impairment on miscellaneous equipment

Leasehold improvements

Less: Accumulated depreciation and impairment on leasehold improvements

Construction in progress

Net Properties

2015

2014

$ 307,788,236

20,038,533

45,210,627

27,824,467

502,123,517

406,305,692

21,879,018

17,595,703

5,160,394

4,404,985

0

0

22,480,162

$ 428,472,574

$ 308,500,445

19,649,066

44,819,638

26,663,515

494,792,238

394,606,681

21,780,691

16,984,911

5,118,229

4,333,904

0

0

20,477,667

$ 433,250,831

PROPERTY, PLANT AND EQUIPMENT

a. De ned contribution plan

The Corporation adopted a pension plan under the Labor Pension Act (the "LPA"), which is a state-managed defined

contribution plan. Under the LPA, an entity makes monthly contributions to employees' individual pension accounts at 6% of

monthly salaries and wages.

b. De ned bene t plan

The defined benefit plan adopted by the Corporation in accordance with the Labor Standards Law is operated by the

government. Benefits under the plans are based on employee's length of service and average monthly salaries of the last

three months before retirement (for the length of service before the LSL was enacted) or six months before retirement (for the

length of service after the LSL was enacted).

Personnel employed by the Corporation are referred to as either appointees or employees.The appointees' retirement fund (ARF),

established under the guidelines of the Ministry of Economic Affairs, requires monthly contributions of amounts equal to 15% of monthly

salaries and is administered by a pension plan committee.The ARF is deposited in the committee's name in a bank.

Based on an actuarial report, since the contribution surplus in plan assets exceeded the defined benefit obligation, the

Corporation need not continue to contribute to the plan assets starting from July 2012. The employees' retirement fund (ERF)

entails monthly contributions by the Corporation to a fund at amounts equal to a fixed percentage of 15% of salaries and

wages. The ERF is administered by a monitoring committee and is deposited in the committee's name in the Bank of Taiwan.

Based on an actuarial report, the Corporation should contribute to the ERF amounts equal to a fixed percentage of 2% of

taxable payroll starting from July 2013. Before the end of each year, the Corporation assesses the balance in the pension

fund. If the amount of the balance in the pension fund is inadequate to pay retirement benefits for employees who conform to

retirement requirements in the next year, the Corporation is required to fund the difference in one appropriation that should be

made before the end of March of the next year. The pension fund is managed by the Bureau of Labor Funds, Ministry of Labor

("the Bureau"); the Corporation has no right to influence the investment policy and strategy.

The Corporation awarded specific retired employees consolation benefits in accordance to corporate polices.

The Corporation adopted an insurance system called the Government Employee and School Staff Insurance ("GESSI"), which is a state-

managed insurance plan. Under GESSI, an entity makes monthly contributions based on the employee's monthly insurance salary.

The amount included in the balance sheet arising from the Corporation's obligation in respect of its defined benefit plans was

as follows:

55

Financial Statement