b. Deferred tax

Deferred tax is recognized on temporary differences between the carrying amounts of assets and liabilities and the

corresponding tax bases used in the computation of taxable profit.

Deferred tax liabilities are generally recognized for all taxable temporary differences. Deferred tax assets are generally

recognized for all deductible temporary differences, unused loss carry forward and unused tax credits for purchases of

machinery, research and development expenditures, and personnel training expenditures to the extent that it is probable

that taxable profits will be available against which those deductible temporary differences can be utilized.

Deferred tax liabilities are recognized for taxable temporary differences associated with investments in associates, except

where the Corporation can control the reversal of the temporary difference and it is probable that the temporary difference

will not reverse in the foreseeable future. Deductible temporary differences associated with such investments and interests

are only recognized to the extent that it is probable that there will be sufficient taxable profits against which to utilize the

temporary differences and they are expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at the end of each reporting period and reduced to the extent that

it is no longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered. A

previously unrecognized deferred tax asset is also reviewed at the end of each reporting period and recognized to the

extent that it has become probable that future taxable profit will allow the deferred tax asset to be recovered.

Deferred tax liabilities and assets are measured at the tax rates that are expected to apply in the period in which the liability

is settled or the asset realized, based on tax rates and laws that have been enacted or substantively enacted by the end

of the reporting period. The measurement of deferred tax liabilities and assets reflects the tax consequences that would

follow from the manner in which the Corporation expects, at the end of the reporting period, to recover or settle the carrying

amount of its assets and liabilities.

c. Current and deferred taxes for the year

Current and deferred taxes are recognized in profit or loss, expect when they relate to items that are recognized in other

comprehensive income or directly in equity, in which case, the current and deferred taxes are also recognized in other

comprehensive income or directly in equity, respectively.

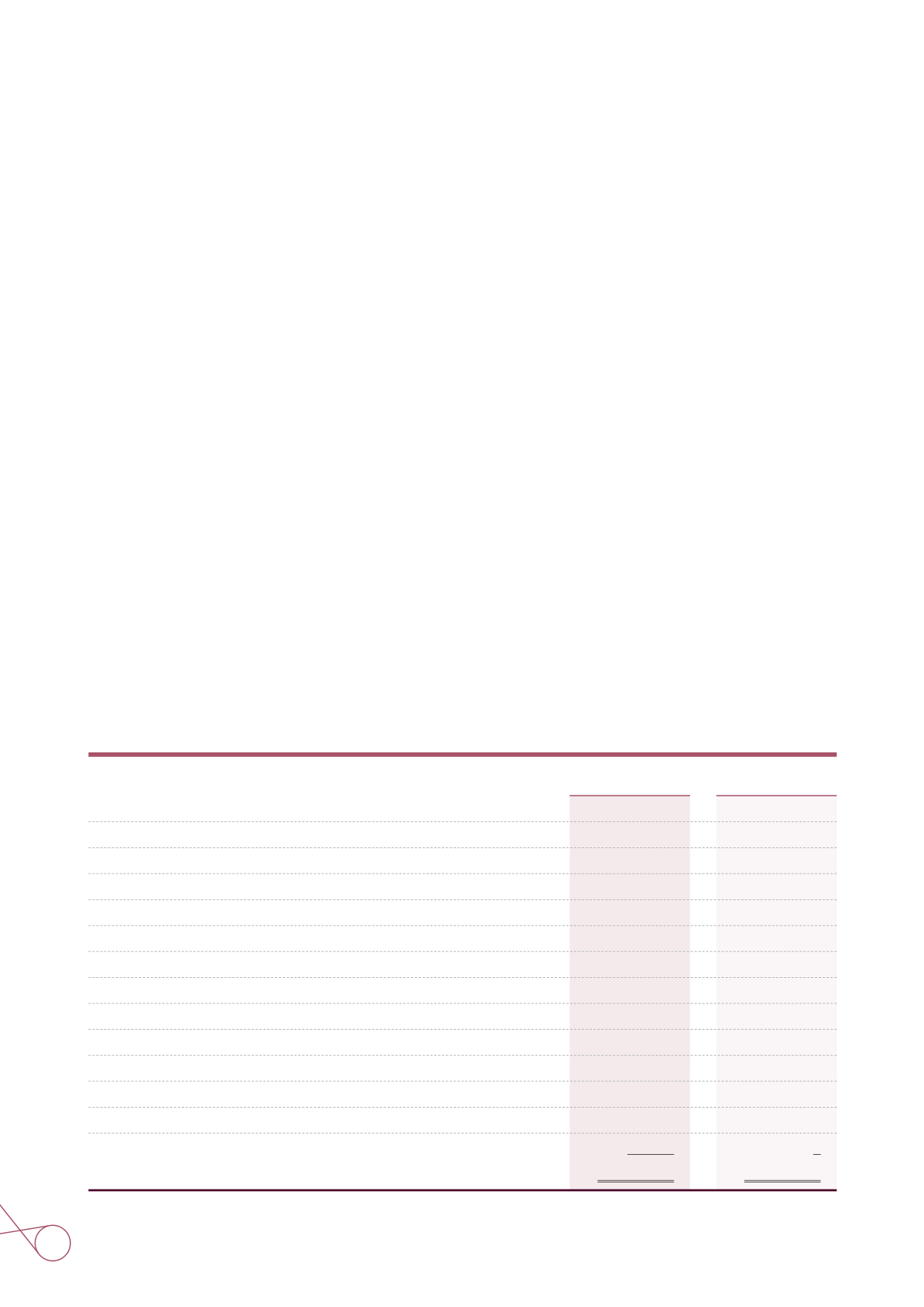

INVESTMENTS ACCOUNTED FOR USINGTHE EQUITY METHOD

December 31, 2015 and 2014

(In Thousands of New Taiwan Dollars)

Investments in associates

Unlisted companies

China American Petrochemical Co., Ltd.

-CPC owned 38.64% equity

Kuo Kuang Power Company Ltd.

-CPC owned 45% equity

Faraway Maritime Shipping Corp.

-CPC owned 40% equity

NiMiC Ship Holding Co., Ltd.

-CPC owned 45% equity

Taiwan Advanced Material Corporation

-CPC owned 49% equity

Chun Pin Enterprise Co., Ltd.

-CPC owned 49% equity

Global Energy Maritime Co., Ltd.

-CPC owned 48% equity

CPC Shell Lubricants Company Ltd.

-CPC owned 49% equity

Daihai Petrol Corporation.

-CPC owned 35% equity

NiMiC Ship Management Co., Ltd.

-CPC owned 45% equity

Kuokuang Petrochemical Technology Co., Ltd.

-CPC owned 43% equity

Taiwan-Japan Oxo Chemical Industries Inc.

-CPC owned 47% equity

2015

2014

$ 1,739,242

2,755,336

2,115,021

2,097,051

652,510

356,290

1,791,307

79,965

125,423

41,434

19,953

140,252

$ 11,913,784

$ 2,353,380

2,753,037

2,079,181

1,686,579

697,283

365,055

876,080

269,300

117,923

32,573

19,882

0

$ 11,250,273

54 CPC 2016