10

1

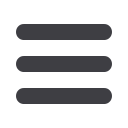

2 3 4 5 6 7

8 9 11 12 13 14 15

16 17 5 6

Fields under development

or producing

Fields under exploration

Fields being developed in

cooperation with China

10

1

2

3

4

5

6

7

8

9

US - Colorado

KC320(20%)

Operator:Mendell

US-Louisiana / Texas boundary

Big Horn(11.2%)

Shoats Creek(5%)

S.Bancroft(10%)

Danube(10%)

Yellowstone(10%)

NW Bearhead Creek(10%)

East Skinner Lake(10%)

Operator:Indigo Minerals

Skinner Lake(5%)

Operator:Will Drill

US-Louisiana

Austin Chalk(20%)

Operator:Yuma

Increasing involvement in overseas

exploration

The likelihood of Taiwan's terrestrial oil and gas fields

becoming depleted over the next ten years calls for action to

replace their output. We are therefore continuing our efforts

with both domestic and foreign exploration and production, as

well as engagement with suitable M&A opportunities.

Taking foreign exploration as an example: in 2015, six

exploratory wells were drilled in the Chali West III block and

other areas in Chad; oil and gas were found in two of them and

the current drilling of one confirmatory well is being expedited.

Two exploratory wells were drilled in Libya's Murzuq 162 Block

and both turned out to be dry. The outbreak of civil war in that

country forced CPC's local subsidiary to suspend operations

and continuing unrest has precluded both their resumption

and completion of one obligatory well.

In mid-2015 CPC acquired three concessions in Texas - the

San Jac, Lazy M5 and Snickers; three wells were drilled, of

which two were producers.

Upstream has produced outstanding results

From their beginnings in 1959, CPC's upstream operations

- exploration and production at both onshore and offshore

oil and gas fields in Taiwan, the Taiwan Strait and overseas

– have been highly successful in terms of yield, which so far

amounts to over NT$200 billion-worth.

The inherent vision behind upstream is to see the company

become an international oil and gas exploration player with

high asset value.

Accordingly, CPC's upstream entities will maintain their

efforts with international cooperation and M&A in exploration

to boost autonomously-controlled oil and gas reserves – by

acquiring mid-to-small oil and gas fields, especially those

with low risk, and extending contracts with producing fields -

and will seek opportunities for investment in overseas assets

during times of low oil prices. In addition, development of

diversified business operations including green industries

will be ongoing.

CPC's performance in Exploration & Production

over the last three years

* Total operating revenue: NT$1.19 trillion in 2013, NT$1.19 trillion in 2014

and NT$844 billion in 2015.

Unit: NT$ Million

Year

2013

2014

2015

Revenue

Operating costs

Earnings

Pre-tax profit

16,631

12,159

4,472

4,368

1.40%

Revenue as a share of

the Company's total

operating revenue*

14,228

12,895

1,333

783

1.19%

9,947

8,784

1,163

1,205

1.18%

10 CPC 2016