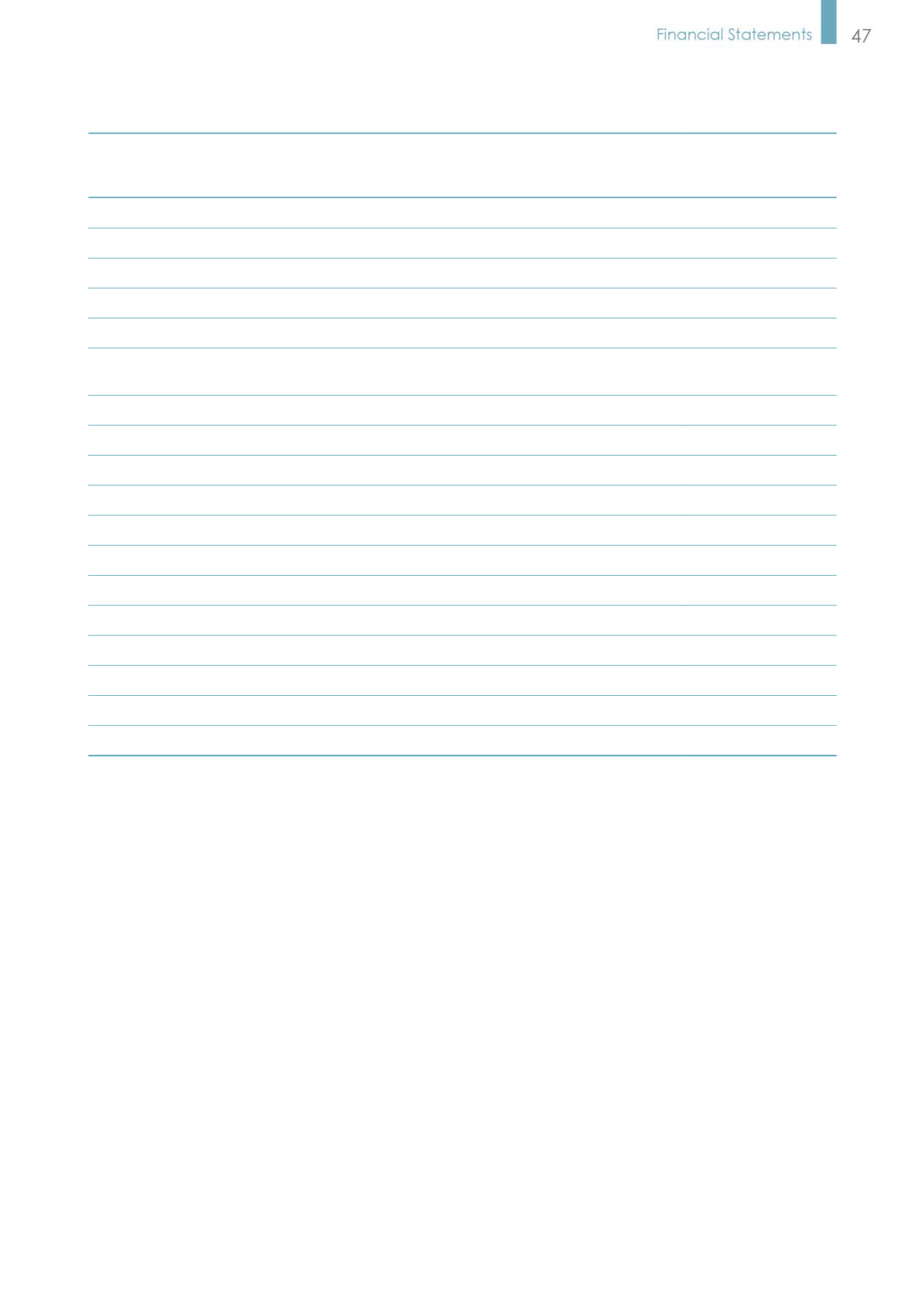

New IFRSs

Effective Date

Announced by IASB

(Note 1)

Annual Improvements to IFRSs 2010-2012 Cycle

July 1, 2014 (Note 2)

Annual Improvements to IFRSs 2011-2013 Cycle

July 1, 2014

Annual Improvements to IFRSs 2012-2014 Cycle

January 1, 2016 (Note 4)

IFRS 9 “Financial Instruments”

January 1, 2018

Amendments to IFRS 9 and IFRS 7 “Mandatory Effective Date of IFRS 9 and Transition Disclosures”

January 1, 2018

Amendments to IFRS 10 and IAS 28 “Sale or Contribution of Assets between an Investor and its

Associate or Joint Venture”

January 1, 2016 (Note 3)

Amendments to IFRS 10, IFRS 12 and IAS 28 “Investment Entities: Applying the Consolidation Exception” January 1, 2016

Amendment to IFRS 11 “Accounting for Acquisitions of Interests in Joint Operations”

January 1, 2016

IFRS 14 “Regulatory Deferral Accounts”

January 1, 2016

IFRS 15 “Revenue from Contracts with Customers”

January 1, 2017

Amendment to IAS 1 “Disclosure Initiative”

January 1, 2016

Amendments to IAS 16 and IAS 38 “Clarification of Acceptable Methods of Depreciation and Amortization” January 1, 2016

Amendments to IAS 16 and IAS 41 “Agriculture: Bearer Plants”

January 1, 2016

Amendment to IAS 19 “Defined Benefit Plans: Employee Contributions”

July 1, 2014

Amendment to IAS 27 “Equity Method in Separate Financial Statements”

January 1, 2016

Amendment to IAS 36 “Impairment of Assets: Recoverable Amount Disclosures for Non-financial Assets” January 1, 2014

Amendment to IAS 39 “Novation of Derivatives and Continuation of Hedge Accounting”

January 1, 2014

IFRIC 21 “Levies”

January 1, 2014

Note 1: Unless stated otherwise, the above New IFRSs are effective for annual periods beginning on or after their respective

effective dates.

Note 2: The amendment to IFRS 2 applies to share-based payment transactions with grant date on or after July 1, 2014; the

amendment to IFRS 3 applies to business combinations with acquisition date on or after July 1, 2014; the amendment

to IFRS 13 is effective immediately; the remaining amendments are effective for annual periods beginning on or after

July 1, 2014.

Note 3: Prospectively applicable to transactions occurring in annual periods beginning on or after January 1, 2016.

Note 4: The amendment to IFRS 5 is applied prospectively to changes in a method of disposal that occur in annual periods

beginning on or after January 1, 2016; the remaining amendments are effective for annual periods beginning on or

after January 1, 2016.

The initial application of the above New IFRSs, whenever applied, would not have any material impact on the Corporation’s

accounting policies, except for the following:

1) IFRS 9 “Financial Instruments”

Recognition and measurement of financial assets

All recognized financial assets that are within the scope of IAS 39 “Financial Instruments: Recognition and Measurement”

are subsequently measured at amortized cost or fair value. Under IFRS 9, for debt instruments with contractual cash flows

that are solely payments of principal and interest on the principal amount outstanding, their classification and subsequent

measurement are as follows:

a) If the debt instruments are held within a business model whose objective is to collect contractual cash flows, they are

measured at amortized cost and are assessed for impairment continually, with any impairment loss recognized in profit or

loss. Interest revenue is recognized in profit or loss by using the effective interest method;