█

Under development/

producing fields

█

Fields under exploration

█

Fields being developed in

cooperation with China

US – Colorado

1

KC320 (20%)

Operator: Medell

US – Louisiana /

Texas boundary

2

Big Horn (11.2%)

3

Shoats Creek (5%)

4

S. Bancroft (10%)

5

Danube (10%)

6

Yellowstone (10%)

7

NW Bearhead Creek (10%)

8

East Skinner Lake (10%)

Operator: Indigo Minerals

9

Skinner Lake (6.32%)

Operator: Halcon

foreign exploration and production and to engage with suitable merger and

acquisition opportunities.

Taking foreign exploration as an example: five exploratory wells have been

drilled in the Chali West III block and other areas in Chad; oil and gas have

been discovered in two of the drill sites. A third stage of the project, which

involves the drilling of six confirmatory wells, is currently underway. Two

exploratory wells were drilled in Libya's Murzuq 162 Block and both turned

out to be dry. The outbreak of civil war there forced CPC's local subsidiary to

suspend operations; continuing unrest means that operations have not yet

been resumed and one obligatory well has not yet been completed.

With regard to cooperative exploration, CPC plans to drill one exploratory well

in each of Congo Brazzaville's Haute Mer field and Australia's Ashmore, Cartier

Islands 21 and Ichthys fields during 2015. We are also currently conducting a

3D seismic survey and data interpretation in Niger's Agadam area and planning

both a 500-kilometer time-frequency electromagnetic survey and the drilling of

15 exploratory wells and five confirmatory wells.

CPC obtained numerous oil and gas exploration rights in 2014, including

the 20% of operations at Bofu Lake field in Texas; 2.625% of the output

of Australia's Ichthys field during the development period; and 5% of the

output from Australia's Prelude gas field during the development period. The

procurement of the latter two gas field assets is coupled with a planned floating

liquefied natural gas (FLNG) installation, under which CPC will procure 2.0

million tons of LNG from Shell each year for 20 years starting in 2016. The two

fields are expected to formally begin production in 2017.

CPC turns in an outstanding performance in exploration; this continues along

with M&A activity

CPC's upstream operations began in 1959 and have comprised exploration

and exploitation of both onshore oil and gas fields in Taiwan, offshore in the

Taiwan Strait and overseas. This very successful effort has so far yielded oil

and gas to the value of over NT$200 billion.

CPC's strategy for expansion has been the basis of its continuing engagement

in both the exploration of oil and gas fields worldwide and in opportunistic

M&A activity. Making good use of an outsourcing strategy, CPC has acquired a

high-end assessment and interpretation system and integrated knowledge base

applicable to exploration. The vision inherent in CPC's upstream operations

is to see the company become an international oil and gas exploration

enterprise with high asset value. Apart from, CPC will endeavor to increase its

autonomously controlled oil and gas reserves by both enhancing the value of

its existing foreign operational oil and gas assets and by actively bidding for

shares of newly-opened fields in high-growth core areas as well as seeking

opportunities for the transfer of rights to promising fields.

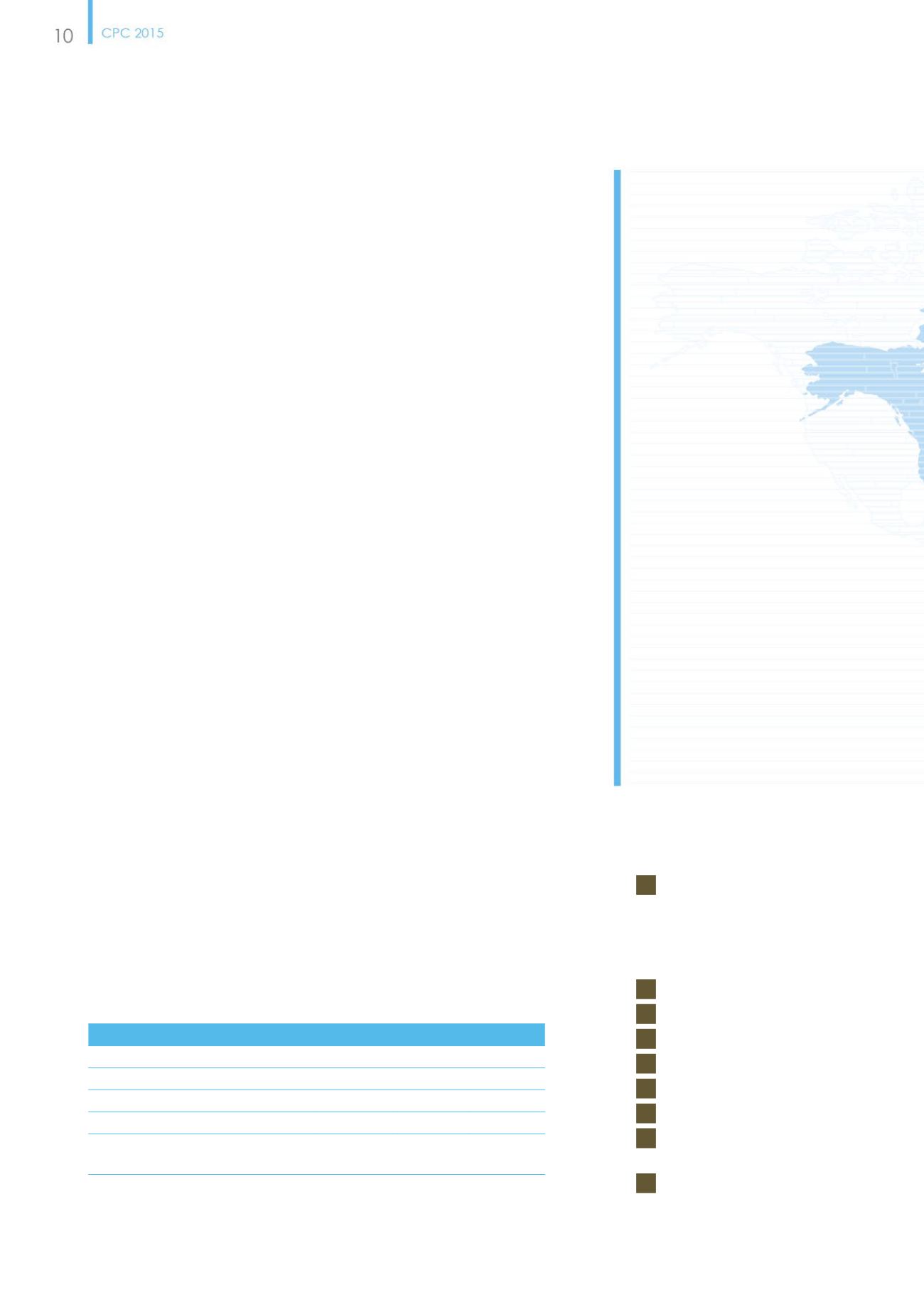

CPC's exploration and production performance during the most recent three years

Units: NT$1 million

Year

2012

2013

2014

Revenue

16,112 16,631 14,228

Operating costs

8,873 12,159 12,895

Earnings

7,239

4,472

1,333

Pre-tax profit

7,708

4,368

783

Revenue as a share of the company's

total operating revenue*

1.40% 1.40% 1.19%

* Total operating revenue: NT$1.15 trillion in 2012; NT$1.19 trillion in 2013, NT$1.19 trillion in 2014